ABLE NRC champions the vital role that people with disabilities play in a diverse and inclusive workforce. We celebrate the contributions and elevate the voices of working ABLE account owners throughout our activities and resources.

In honor of National Disability Employment Awareness Month (NDEAM), this issue of the AchievABLE newsletter highlights strategies and resources for using ABLE accounts to support successful work, career and retirement outcomes for people with disabilities.

The September/October issue of our AchievABLE™ Newsletter contains stories on the following:

- Join Us on Thursday, October 27th from 2-3pm ET for ABLE NRC’s Ready and ABLE to Work and Save Panel

- #ABLEtoSave Podcast Series: ABLE and Self-Employment

- New ABLE Decision Guide: Ready and ABLE to Work and Save

- Top 3 ABLE Employment and Self-Employment Related Questions

- IRS Announces Annual ABLE Contribution Limit Will Increase to $17,000 in 2023

- ABLE National Resource Center “In the News”

- ABLE NRC’s Upcoming Webinars and New Webinars On-Demand

Join Us on Thursday, October 27th from 2-3pm ET for Ready and ABLE to Work and Save Panel

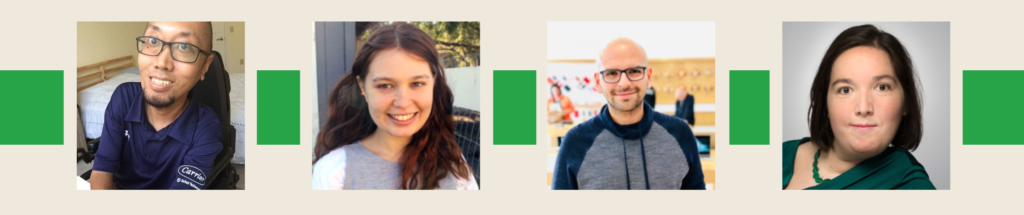

In this panel discussion, in honor of October’s National Disability Employment Awareness Month (NDEAM), you will hear from Emily, Simon, Taylor and Eric, all of whom are ABLE account owners in different professions at various stages in their work lives. What they all have in common is they are each using their ABLE account to advance in their careers and plan for retirement.

Our panelists will share their employment journeys and the specific ways in which they are using their ABLE accounts to achieve success. You will take away an increased understanding of the advantages an ABLE account can offer to those who are working age and ABLE-eligible.

The panel discussion will cover:

- Examples of ABLE accounts supporting people with disabilities in a variety of careers;

- ABLE strategies to support employment, career advancement and retirement planning; and

- The New ABLE Decision Guide, “Ready and ABLE to Work and Save.”

Panelists:

- Emily Munson, Esq. Policy Director for Indiana Disability Rights

- Simon Cantos, Mechanical Engineer for Carrier Air Conditioning Company

- Taylor Carty, Research Assistant for Syracuse University

- Eric Cardenas, Lecturer II at University of Texas Rio Grande Valley

An ABLE account is a powerful tool that can make it possible for eligible, working-age people with disabilities to save, invest and improve their lives.

#ABLEtoSave Podcast Series: ABLE and Self-Employment

Join us for a new #ABLEtoSave podcast series featuring experts who describe how ABLE accounts can increase financial independence through building assets to help people with disabilities become self-employed and grow their business.

ABLE Accounts: A Tool for Self-Employment Planning

In this podcast, nationally renowned self-employment topic expert, Molly Sullivan with Griffin-Hammis Associates, shares her perspective and insights on the role that ABLE accounts can play in helping people with disabilities become self-employed.

In this podcast, nationally renowned self-employment topic expert, Molly Sullivan with Griffin-Hammis Associates, shares her perspective and insights on the role that ABLE accounts can play in helping people with disabilities become self-employed.

The “ABLE Accounts: A Tool for Self-Employment Planning” podcast episode includes:

- How an ABLE account has the potential to support building individual savings and assets for those who wish to pursue self-employment.

- Examples from Griffin-Hammis Associates on how ABLE accounts can be built into self-employment planning.

- Specific self-employment strategies that utilize an ABLE account.

Using an ABLE Account to Become Self-Employed

In this podcast, asset-building topic expert and ABLE account owner, Chris Peterson, discusses his personal financial story. Learn how Chris uses his ABLE account to continue to build and shift into working full-time for his new nonprofit organization, Penny Forward , a community of blind people building bright futures one penny at a time.

In this podcast, asset-building topic expert and ABLE account owner, Chris Peterson, discusses his personal financial story. Learn how Chris uses his ABLE account to continue to build and shift into working full-time for his new nonprofit organization, Penny Forward , a community of blind people building bright futures one penny at a time.

The Using an ABLE Account to Become Self-Employed Podcast episode includes:

-

- How building assets can support career advancement for people with disabilities and, specifically, people who are blind.

- Examples of ABLE accounts being used by Penny Forward community members who are ABLE-eligible due to blindness or vision loss.

- ABLE account strategies that Chris Peterson, founder of Penny Forward, uses to support his financial independence and, specifically, how he is using his ABLE account to transition into self-employment.

New ABLE Decision Guide: Ready and ABLE to Work and Save

The combination of earnings and savings from employment enhances long-term financial well-being and security for most working-age people.

If you are a working-age, ABLE-eligible person with a disability you can use savings from your ABLE account to support you throughout your employment journey without effecting eligibility for most federally-funded means-tested benefits. Once you are working, you can save some – or even all – of your income in your ABLE account for a wide of array of short-term and long-term financial goals, including retirement.

There are many reasons you might be considering going to work, especially if you receive a disability benefit from the Social Security Administration (SSA). Many Social Security recipients find it challenging to meet all their financial needs with just their SSA cash benefit. According to SSA, in July 2022, SSA reported that the average Social Security Disability Insurance (SSDI) payment was $1,362 and the average Supplemental Security Income payment was $624.

Employment can increase your income, helping you save more for your future. There are also other reasons to consider employment. Working people can experience additional benefits that range from meeting co-workers and customers to being more active in their community. There can be a sense of pride associated with work and this can be especially true for people with disabilities, many of whom may not have thought that work was an option for them. As a person with a disability, there are specific topics that you need to understand and plan for as you explore and move into employment.

The ABLE National Resource Center has information to help you, and those supporting you, as you consider employment and how an ABLE account can support and enhance your financial health and well-being.

This ABLE Decision Guide will provide guidance on how to effectively use your ABLE account to help you get a job, keep a job, advance in your career and save your employment earnings to achieve your financial goals.

AchievABLE™ Top 3 Questions

1. If the Internal Revenue Service (IRS) were to review and disallow one or more of my employment-related qualified disability expenses (QDE), is there a process in place for me to appeal their determination?

Yes, there is a process to appeal such a decision. However, it is important to know that any employment expenses which enhance an ABLE account owner’s health, independence or quality of life are considered a qualified disability expense. Services, supports and products purchased using funds from your ABLE account to help the account owner pursue and/or maintain employment would fall into this broad category.

For more information on how to make an appeal, visit the IRS Office of Appeals’ website or consult IRS Publication 5: Your Appeal Rights and How to Prepare a Protest If You Don’t Agree.

2. As an ABLE account owner who is working, can I have an ABLE account and also contribute into a 401(k) that is matched by my employer?

You can have both an ABLE account and, if you are working, you can also contribute to a 401(k) or a 403(b) into which your employer contributes. This is perfectly allowable and a common practice among ABLE account owners who are not receiving any public, means-tested benefits.

However, if you are an ABLE account owner who is receiving a means-tested benefit – perhaps you are on a Medicaid Waiver – it may make sense to use your ABLE account to save for retirement to ensure you remain eligible for those benefits.

Importantly, if you are employed and do not have a retirement account that an employer matches or otherwise funds, you have an ABLE contribution limit that is higher than the annual calendar limit of $16,000. This is good news!

In this case, you can put additional funds from your earnings into your ABLE account above the $16,000 annual ABLE account limit available for all contributors (e.g., family, friends, etc.). This will allow you to save for retirement and other long-term needs and maintain eligibility for benefits whereas you might not otherwise have had this opportunity. Additional contribution limits from employment earnings come from whichever is less:

-

- Your (the ABLE account owner’s) gross income for that taxable year,

OR

-

- $12,880 if you live in the continental United States;

- $16,090 if you live in Alaska; or

- $14,820 if you live in Hawaii.

- $12,880 if you live in the continental United States;

Check out the ABLE NRC’s ABLE To Work Act fact sheet to learn more.

3. If I work and deposit my employment earnings into my ABLE account, do I have to report my earnings to the Social Security Administration (SSA) and file income taxes?

Depositing employment income into an ABLE account does not reduce countable earned income. A person who receives Supplemental Security Income and/or Social Security Disability Insurance on their own work record or on a parent’s work record is eligible for work supports provided by the Social Security Administration. The SSI and SSDI work supports may reduce countable earned income and help a person qualify for SSI, SSDI, Medicaid and Medicare longer and, sometimes, indefinitely.

An SSI and/or SSDI beneficiary who works, or is ready to work, can learn about the specific work supports they are eligible for by contacting a Work Incentive Planning Associate (WIPA) or a Community Work Incentive Coordinator (CWIC) for free benefits advisement.

Beneficiaries will be advised on how to report their earnings, and their use of SSA work supports, to SSA. They will also receive information about other work supports they may be eligible for if they receive HUD, SNAP, TANF or other public benefits.

It is important that everyone who has employment income file income taxes whether they have received cash payments, 1099s or W2s. When filing their income taxes, it is important to make sure that FICA has been paid. This ensures that a person who has earned enough money has the opportunity to accrue work credits on their own work record with SSA. Qualifying for enough quarters of coverage can qualify a person and other family members for SSDI on their own work record, Medicare and retirement benefits in the future.

A person who has not filed income taxes can file up to three years now and they may be eligible for Earned Income Tax Credits and/or Saver’s Tax Credits which can be deposited into an ABLE account. SSA will correct a person’s work record up to the last three years, if requested. You can find your Volunteer Income Tax Assistance (VITA) or TCE site by using the VITA Locator Tool or call 1-800-906-9887.

IRS Announces Annual ABLE Contribution Limit Will Increase to $17,000 in 2023

On Wednesday, October 19, 2022 the IRS released their annual list of inflation adjustments in IRS Revenue Procedure 2022-38 yesterday. The reference contains the 2023 amounts for some common tax credits (e.g. child tax credit, earned income tax credit).

Section .43 on Page 20 also notes that there will be an increase in the annual exclusion for gifts. The annual ABLE contribution limit is tied to the gift tax exclusion which means that the ABLE contribution limit will increase on January 1, 2023 from the current $16,000 for the calendar year to $17,000. View this document to learn more.

ABLE NRC In the News

- Consumer Reports: ABLE Accounts Can Help People with Disabilities Save Tax-Free

- USA Today: What You Need to Know About ABLE Accounts

ABLE NRC Upcoming Webinars & Webinars on-Demand

- Ready and ABLE to Work and Save Panel on Thursday, October 27th from 2:00-3:00 p.m. ET. REGISTER

- ABLE Program Spotlight on ABLE America and ABLEnow on Tuesday, November 29th from 2:00-3:00 p.m. ET REGISTER

- ABLE Program Spotlight on National ABLE Alliance View in Webinars On-Demand

- #ABLEtoSave Panels View in Webinars On-Demand